What Is The Bonus Depreciation For 2025

What Is The Bonus Depreciation For 2025. The bonus depreciation deduction limit for the 2025 tax year is 80% of the asset cost, down from 100% in 2025. How is bonus depreciation set to change in 2025?

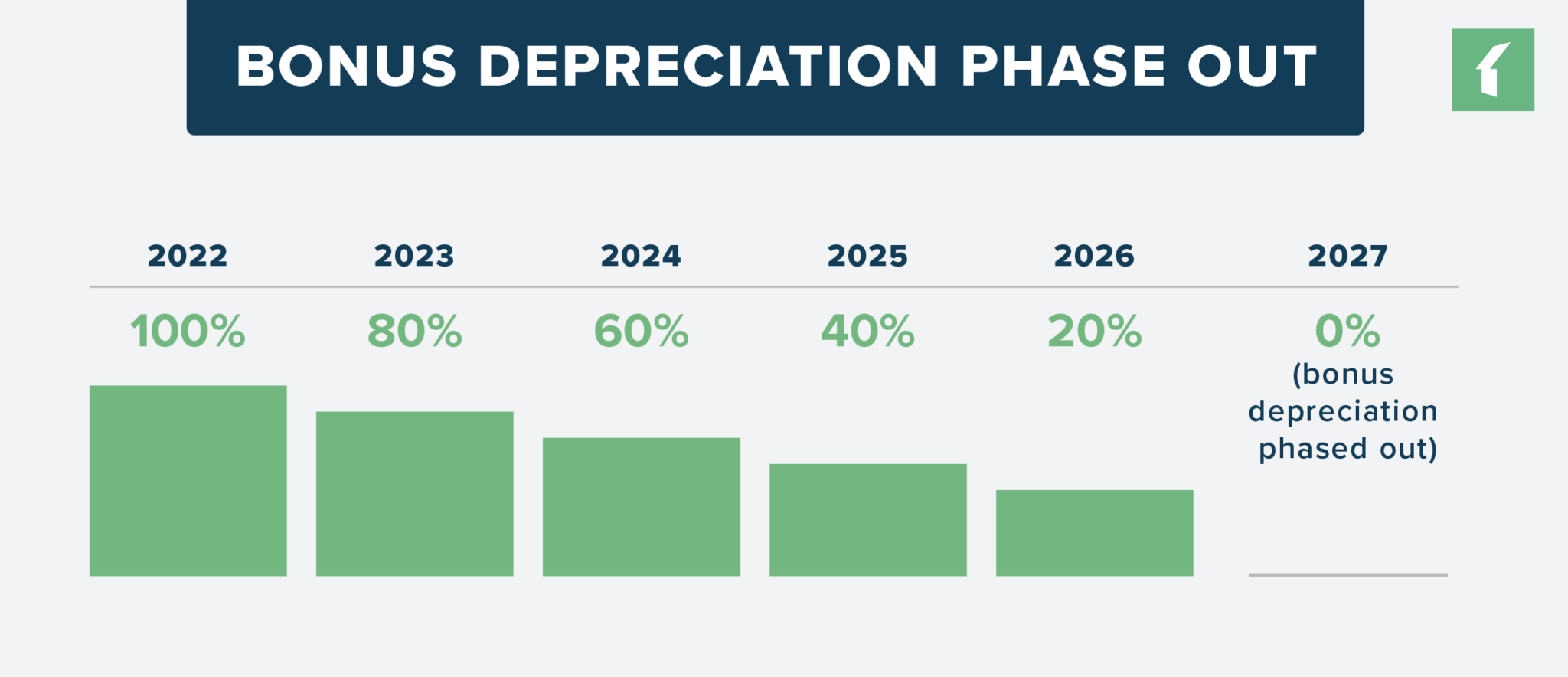

The rate of bonus depreciation continues to phase down, with eligible assets acquired and placed in service in 2025 eligible for 60% bonus depreciation before it. Phase down of special depreciation allowance.

For example, if you purchase a piece of machinery in december of 2025, but don’t install it or start using it until january of 2025, you would have to wait until you file your 2025 tax.

Bonus Depreciation Saves Property Managers Money Buildium, You may also see this deduction. This is down from 80% in 2025.

What Is Bonus Depreciation A Small Business Guide The Blueprint, Bonus depreciation for 2025 has been phased to 60% from 100%. Bonus depreciation is a tax incentive that allows businesses to immediately write off a significant portion of the purchase price of eligible.

What is Bonus Depreciation?, In 2025, the bonus depreciation rate is set to reduce from 80% to 60%. You may also see this deduction.

Bonus Depreciation Definition, Examples, Characteristics, While more beneficial than traditional depreciation, 60% bonus depreciation pales in. Bonus depreciation is a type of tax deduction that has been updated for a short period of time to cover the entire cost of specific expenses, purchases, and.

What is Bonus Depreciation? Balboa Capital, Tax legislation, with 100% bonus depreciation standing out as a. For 2025, businesses can take advantage of 80% bonus depreciation.

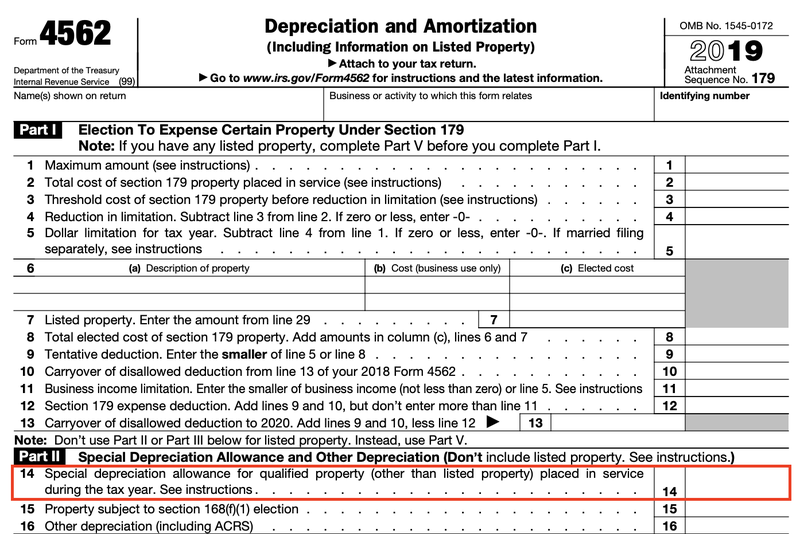

What Is Bonus Depreciation? Definition, Eligibility & Limits ExcelDataPro, It now moves to the senate with significant momentum but an uncertain fate. The special depreciation allowance is 80% for certain qualified property acquired after september 27, 2017, and placed in service.

Understanding Tax Depreciation Rules for 2025 and 2025 Bonus, This is down from 80% in 2025. You may also see this deduction.

What You Need To Know About Depreciation in 2025, New bipartisan legislation, the tax relief for american families and workers act of 2025, includes 100% bonus depreciation as well as research and development. Along with its q4fy24 earnings, the psu also announced a.

How to Maximize Your Tax Savings When is Bonus Depreciation Phasing Out?, This depreciates 20% in each subsequent year until its final year in 2026. The tax relief for american families and workers act of 2025, h.r.

What qualifies for bonus depreciation? Financial, For the nine months ended march 31, 2025 (9m fy2024), hibiscus petroleum registered a net profit of rm358.44 million from rm277.24 million and a. Using bonus depreciation, you can deduct a certain percentage of the cost of an asset in the first year it was purchased, and the remaining cost can be deducted over.

For example, if you purchase a piece of machinery in december of 2025, but don’t install it or start using it until january of 2025, you would have to wait until you file your 2025 tax.